💸 Deutsche Ditches Billion in Bad Loans

Turn Their Loss into Your Gain

Deutsche Bank is cleaning house in a big way, planning to offload around $1 billion in U.S. commercial real estate loans.

They're shaking off these assets because the market's current stability is as questionable as a house of cards.

As they streamline their portfolio, it seems they're prioritizing liquidity over long-term holds.

Passive Cash-Flowing Properties

Buy shares of investment properties, earn rental income & appreciation for anywhere from $100 to $20k — let Arrived take care of the rest.

However, not all old buildings are finding new purposes.

Many old office towers, once the crowning glories of city skylines, now stand neglected, their values plummeting close to zero.

As foreclosures in commercial properties spike, signaling perhaps a bottoming out of the market, there’s a flurry of activity with potential buyers circling around these plots of gold.

In this edition of the AltReports:

💼 Loan Liquidations

📉 Vacancy Vortex

🏢 Tower Turmoil

🧱 Foreclosure Fallout

🏡 Housing Hiccups

Video of the Week: People With 3% Interest Rates ARE LOSING THEIR HOMES!

Chart of the Week: The Delinquency Rate on CMBS Loans is the Highest Since 2013.

Podcast of the Week: How To Use Money To Defeat Real Estate Laws

Deutsche Bank Plans To Offload $1B In U.S. CRE Loans

Deutsche Bank has decided it's time to tidy up the attic, and they're kicking off about $1 billion worth of commercial real estate loans to the curb.

Why? Because apparently, the market for these things is about as stable as a house of cards in a wind tunnel.

It's all part of Deutsche Bank's latest hobby—swapping risk for liquidity, like a financial Marie Kondo, but with less folding and more offloading.

Empty Desks: A Commercial Real Estate Crisis

Commercial real estate is now about as popular as a mall Santa in January, thanks to a little something called the pandemic.

As remote work turns from a temporary trend to a boardroom staple, businesses are ditching their office spaces like last season's fashions.

The big brain move now? Turning these deserted dens of productivity into snazzy apartments or hip mixed-use spaces.

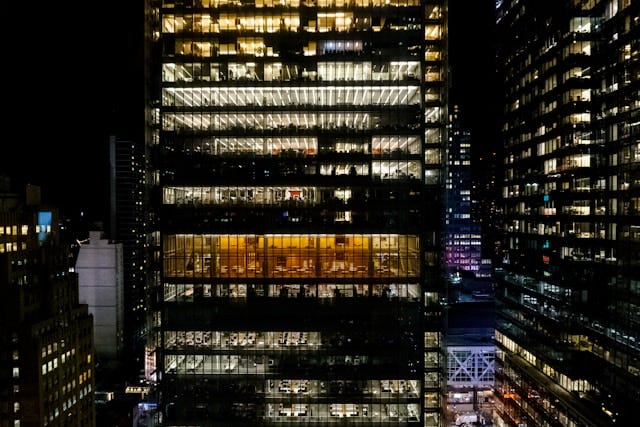

Values of Old Office Towers Go to Near-Zero, but the Land Has Value

Once upon a time, old office towers were the kings of the skyline. Now, they’re just standing there, waiting for someone to please remember they exist.

But—plot twist—the dirt they're standing on? Still worth a pretty penny.

While the buildings themselves flirt with worthlessness, the ground holds potential for something not yet botched by poor investments or panicky headlines.

Surge in Commercial Property Foreclosures Suggest Bottom is Near

It seems every second office or retail space is now sporting a "foreclosure" sign, like it’s some sort of seasonal decoration.

Data's pouring in showing that these aren’t just isolated oopsies—they’re part of a bigger crash landing that the market is bracing for.

Eyes are peeled for any sign of a market pulse as investors hover like buzzards, ready to swoop on what’s left.

Housing inventory is up by a whopping 1.8% from last year—hold the applause, please, it's just a nudge.

New listings, though? Down by 17%, making it clear that not everyone's eager to slap a "For Sale" sign on their lawn.

And while houses are lounging around on the market a tad longer these days, rent prices are on a caffeine high, sprinting up and squeezing wallets nationwide.